Protect Your Life Savings From

Fraud And Scams.

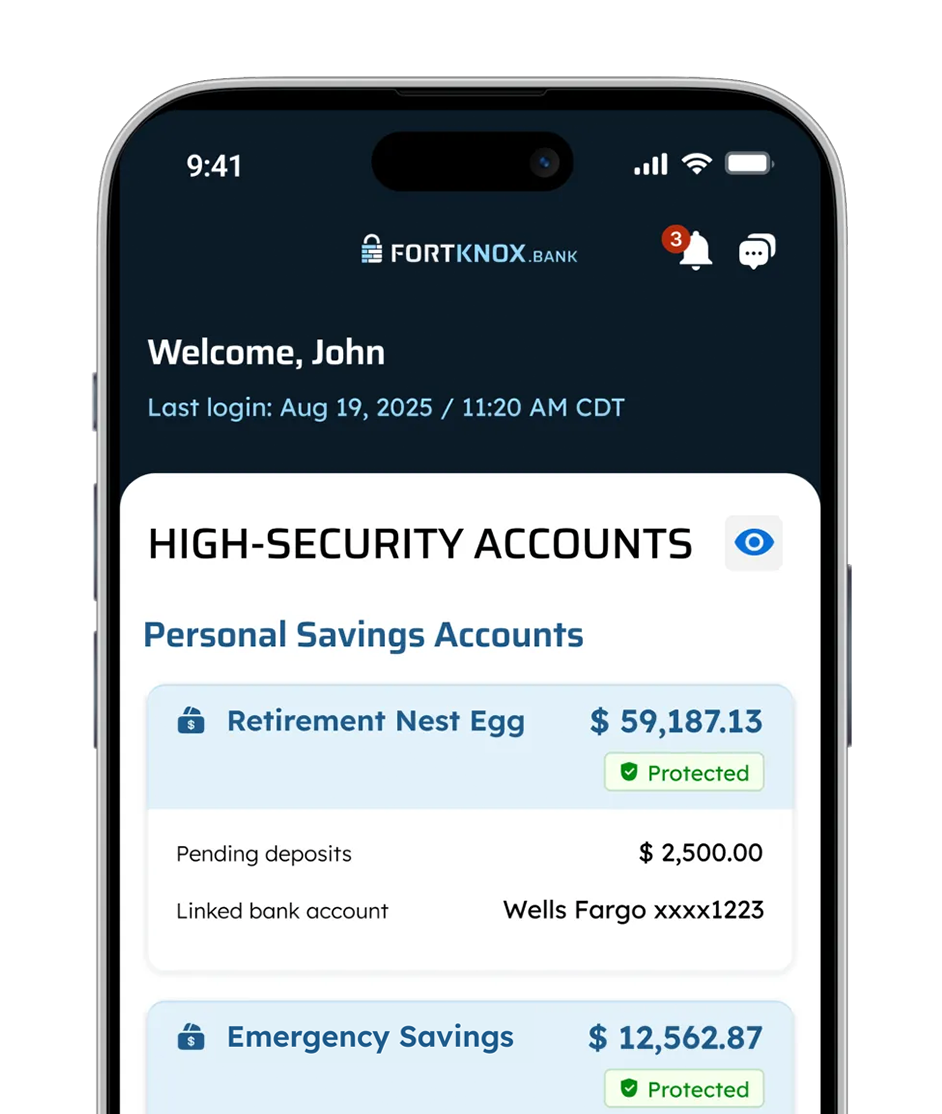

The Fort Knox High-Security Savings Account keeps your money safe behind a Secure Deposit Number™—and earns up to 4.05% APY1 while ensuring your funds can only go back to you.

Open An Account

Fort Knox in the News

Fraud Has Evolved. Banking Hasn’t.

The Problem

- Americans lost nearly $150 billion to fraud in 2025.

- 1 out of 3 Americans have been the victim of a scam or account takeover.

- Account takeover losses average $12,000 per victim.

Traditional Bank Accounts Aren’t Built for This

- Your everyday bank account was designed for convenience, not protection. And convenience is exactly what fraudsters exploit.

- Passwords, text codes, and account numbers are no match for modern fraud.

What Most People Don’t Know

- FDIC Insurance protects you from bank failure – not fraud.

- Most victims only learn this after their money disappears.

The Fort Knox Solution

Fort Knox is a high-security savings account that works seamlessly with your existing checking account. Your real Fort Knox savings account number stays hidden behind a Secure Deposit Number™ (SDN), and withdrawals can only return to your checking account— keeping your money truly protected.

Security Starts With Your

Secure Deposit Number™ (SDN)

Your SDN is a publicly usable bank account number designed for one purpose: bringing money into your Fort Knox account — never taking it out.

It works like a private, one-way gateway:

- Your SDN can receive deposits just like any standard bank account number.

- It can never be used to withdraw funds,even if someone tries.

Behind the scenes, your real Fort Knox Savings Account Number is completely sealed off from the outside world. It’s incompatible with all payment apps, external transfer systems, and digital withdrawal tools — meaning that even if a scammer obtained it, they still couldn’t move a single dollar.

Example SDN

Account Number: 123456789

Routing Number: 987654321

- Your SDN lets money in. Never out.

- Even if criminals steal your SDN, they cannot steal your money.

Example Fort Knox Savings Account Number

Account Number: 74Rt3&nD!v#$89*%

- Completely hidden. Completely unusable by scammers.

- Even if a hacker steals your Fort Knox account number, it is incompatible with all payment apps, transfer systems, and digital withdrawal tools.

Use Your SDN To Securely Receive:

- Paycheck direct deposits

- Social Security and other government benefits

- IRA Required Minimum Distributions

- IRS tax refunds

- Bank-to-bank transfers

- Any deposit that normally requires a bank account and routing number

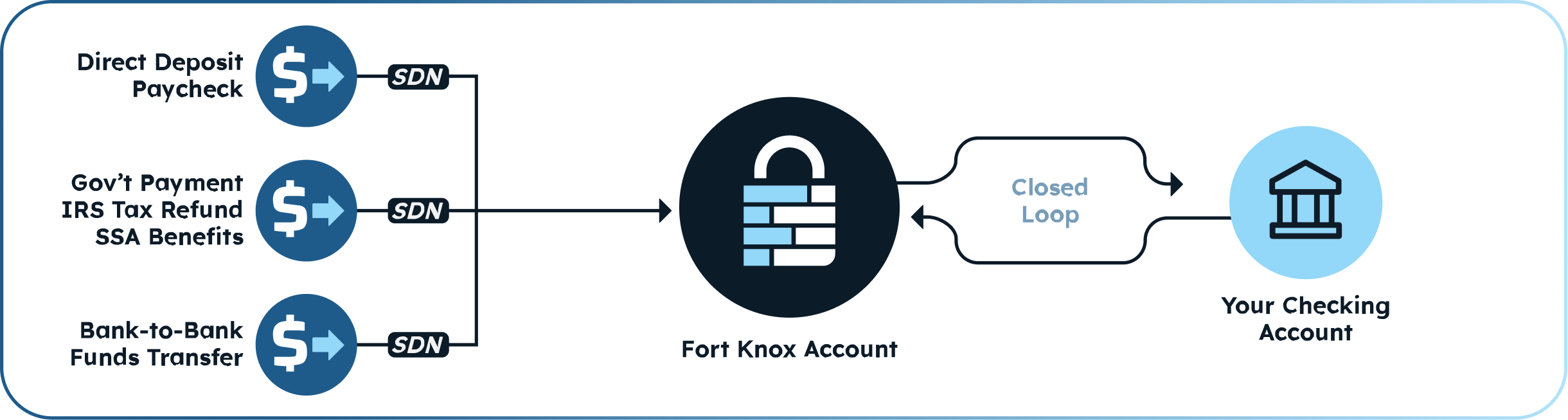

Send Money In.We Lock It Down.

Use your SDN wherever you’d normally provide a bank account for deposits — paychecks, government benefits, refunds, or transfers. Every deposit is automatically swept into your secure Fort Knox savings.

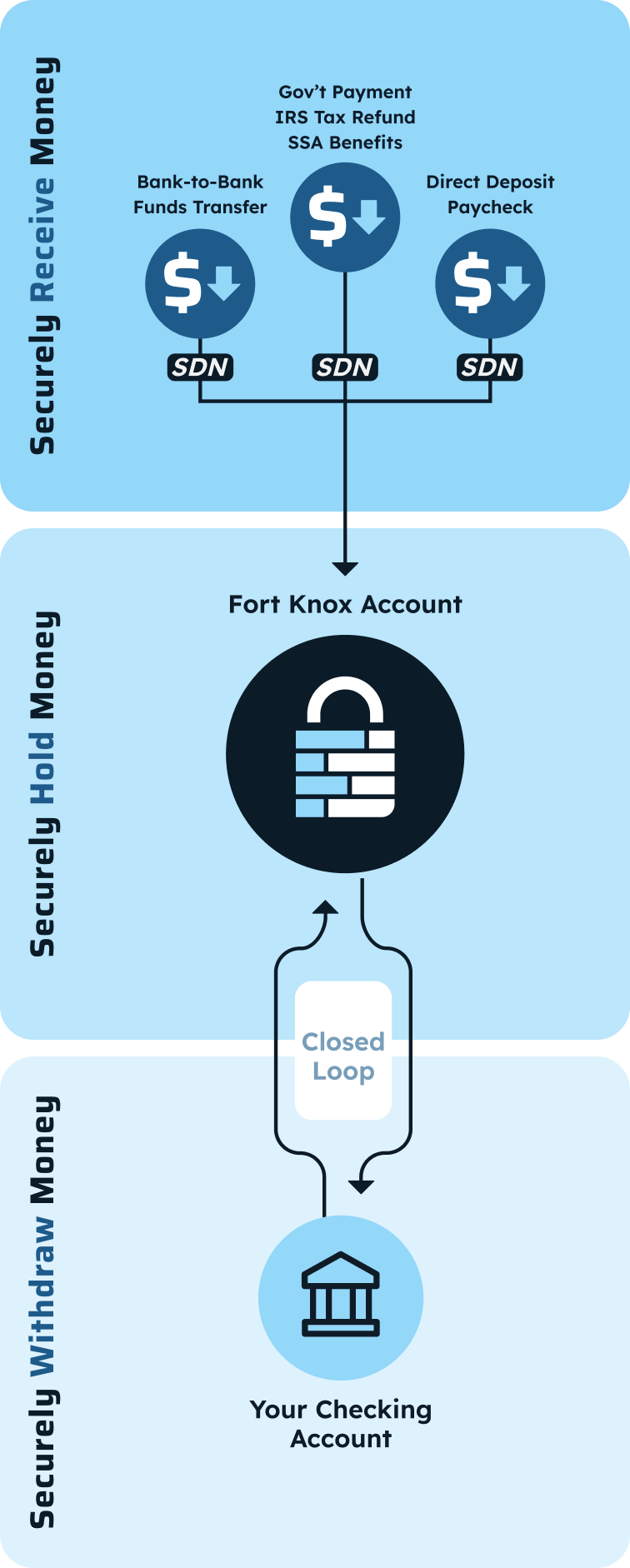

Securely Receive Money

Your Fort Knox account comes with a unique Secure Deposit Number™ (SDN).

Your SDN is a bank account number that can be used publicly to securely receive money from any source. It is NOT your actual account number.

Your SDN works like a one-way trap door. It can receive money – but it can never be used to withdraw money.

Securely Hold Money

The money you receive via your SDN is automatically swept into your High-Security Fort Knox Account.

Your Fort Knox High-Security savings account number is alphanumeric with special characters.

Your account number is incompatible with ALL funds transfer or payment systems. Even if a scammer obtains it – they still can’t move a single dollar.

Securely Withdraw Money

When you open your Fort Knox account we securely link it to the checking account you already have creating a protected closed-loop.

The ONLY place money in your Fort Knox account can go is to your securely linked checking account.

If the secure closed-loop link is ever broken, all funds transfers are frozen, giving you time to respond before any money moves.

Simple Steps.Powerful Protection.

Just link your checking account, deposit through your SDN, and your money is automatically swept into safety.

Connects To Your Existing Checking Account

Link the checking account you already use for deposits and bills. No new checking account to open. No switching required.

learn more

Meet Your Secure Deposit Number™ (SDN)

Your SDN is a private address for your money. It hides your real Fort Knox account number from the outside world. Use it anywhere you’d list a bank account for deposits—payroll, IRS refunds, benefits, and more.

Learn more

Money Moves

Instantly to Safety

When funds hit your SDN, they’re automatically swept into your Fort Knox savings account—hidden, protected, and shielded from scammers.

learn more

Withdraw Only to

Your Checking Account

Your savings can only return to your linked checking account—no third-party apps, no external transfers, no scams. Plus, you can schedule automated withdrawals weekly, monthly, or on your own timeline.

learn moreSee Why People Are Moving Their Savings To Fort Knox

Full disclosure: These testimonials are 100% fake. So is every scammer’s attempt to get your money… but ours are fake for the right reasons. We never reveal customer identities — even for marketing. Enjoy these illustrative examples.

“Finally-peace of mind with my savings.”

– Jennifer A., Austin, TX

“I got hit with a phishing text earlier this year, and it scared me how easily scammers can get into your accounts. Fort Knox is the first place where I actually feel like my savings are insulated from all of that. The Secure Deposit Number makes so much sense—my real account never touches the outside world. This is how banking should work.”

“It works with the checking account I already use.”

— Marcus L., Denver, CO

“What sold me was the simplicity. My paycheck goes to my Fort Knox Secure Deposit Number, and the money instantly moves into my protected savings. And the only place it can go back to is my checking account. No random apps, no mystery transfers. It feels like someone finally built a savings product for the real world.”

“I sleep better knowing nobody can drain my account.”

— Priya S., Des Moines, IA

“My parents almost fell for a ‘bank investigator’ scam last year, so l’ve been hyper-aware of how fast money can disappear. With Fort Knox, even if someone tried to trick me, they couldn’t send my savings anywhere but my checking account. The delayed withdrawals give me time to double-check everything. It’s smart and actually gives me confidence in my finances.”

We’re an

FDIC-Insured Bank,

Not a Fintech.

Fort Knox is a division of Austin Capital Bank, a Federal Deposit Insurance Corporation (FDIC) insured independent community bank headquartered in Austin, Texas. As the bank behind Fort Knox, we’ve been recognized as a national leader in financial services technology, security, and innovation. Our banking platforms have over 1 million users nationwide.

Protect your life savings.

Experience the world’s first high-security savings account built from the ground up to keep your money safe and secure.

Questions about

Fort Knox?

Here are some of the more common questions we get about our High-Security Savings Accounts.

FAQ

Fort Knox is the world’s first High-Security Savings Account—an entirely new category of banking engineered for people who want maximum protection for their money. At the center of Fort Knox is your Secure Deposit Number (SDN), a publicly usable deposit-only account number that allows money in but never out. Your SDN hides your real Fort Knox account number from the outside world and keeps your savings isolated from all external payment systems.

Fort Knox is built on a proprietary, patent-pending Intelligent Closed-Loop™ architecture—featuring Closed-Loop Withdrawal™ Protection, which ensures your savings can only be withdrawn back to your one linked checking account. No apps. No third-party transfers. No alternative destinations.

Combined with CLEAR®’s next-generation biometric identity verification and multiple layers of bank-grade security, Fort Knox fundamentally reimagines how financial institutions protect customer assets. Unlike traditional bank accounts designed around convenience, Fort Knox is built from the ground up to prioritize security at every level. Whether you’re safeguarding your family’s money, protecting your future, or simply want a smarter, safer way to grow your savings—Fort Knox gives you unmatched confidence that your funds are protected.

You can open a personal savings account right away. We’re also in the process of launching business savings accounts, which will be available to select industries and business types where we have extensive expertise. Stay tuned for more updates!

Fort Knox is fundamentally different from every savings account available today. Instead of trying to balance convenience with security, Fort Knox was built from the ground up to stop fraud before it happens.

At the core of this protection is your Secure Deposit Number (SDN)—a deposit-only account number you can safely share. It lets money flow in, but it can never be used to withdraw funds or access your real Fort Knox account number.

Fort Knox also uses our proprietary, patent-pending Intelligent Closed-Loop™ architecture—featuring Closed-Loop Withdrawal™ Protection, which ensures withdrawals can only return to your one verified checking account. No external apps, no alternate destinations, no exceptions.

If suspicious activity is ever detected, your account instantly enters Lockdown™ Status, freezing transfers and giving you time to review and confirm what’s happening. Your Fort Knox account number is also fully restricted and incompatible with all external transfer systems, making it useless to fraudsters even if stolen.

Multiple customizable security zones add additional layers of protection from login through every funds transfer. Within these zones, you can require advanced security tools like a Microsoft Authenticator soft token or a YubiKey physical token.

And unlike traditional banks, Fort Knox never allows instant withdrawals. Every withdrawal includes a mandatory two-day review window—because scams rely on speed, and we remove that advantage entirely.

Fort Knox isn’t just more secure. It’s built to neutralize the modern fraud threat from every angle.

Yes. Your savings are FDIC insured up to $250,000. Subject to FDIC terms and conditions.

Yes, there’s a small monthly maintenance fee of $10/month—but it’s automatically waived when you keep a balance of $1,000 or more in your account. No hidden charges, and no surprises. We want your money to grow, not shrink from unnecessary fees.